Can Nvidia (NASDAQ:NVDA) Stock Hit $1,000? Here’s what the analysts think

Thanks to the assembly led by artificial intelligence, NVIDIA (Nasdaq: NVDA) The stock rose a lot. However, Hans Mosesman of Rosenblatt Securities expects Nvidia shares to double over the next 12 months, which means its price could exceed $1,000. In addition, concerns about its valuation are easing, reflecting consecutive strong quarterly impulses and a solid outlook. Analysts, including Christopher Rowland of Susquehanna and Quinn Bolton of Needham, find NVDA’s current valuation reasonable, pointing to greater upside potential.

On Aug. 23, Mousaman raised his ratings for Nvidia after second-quarter earnings and upbeat third-quarter guidance. “Nvidia’s epic print and run for two consecutive quarters is simply unprecedented and is just beginning,” he said. It raised the price target to $1,100 (which implies an upside potential of about 139% from current levels) from $800 and maintains the Buy rating.

Another analyst, Roland, raised his price target for NVDA stock to $600 from $575, driven by strong demand and an improving supply chain. In a note to investors dated August 24, the analyst said that “the demand looks unlimited” in the near term. Furthermore, Rowland deemed NVDA’s valuation reasonable and raised the price target to $600 from $575. Meanwhile, Bolton finds Nvidia’s valuation attractive and finds the risk/reward of the stock “favourable”.

Although these analysts are bullish on NVDA stock and see further upside, the company faces challenges ahead.

The main challenges

As Nvidia prepares to capitalize on increased investment in generative AI, export restrictions to China (a key market for the company), emerging competition, and concerns about whether Nvidia can sustain its current rate of growth pose challenges.

Bolton does not believe that the export restrictions will have a significant impact on NVDA in the near term, although the ongoing chip war between the US and China remains a cause for concern. Moreover, the analyst believes that the decline in sales from China “will be filled by other geographies.”

Moreover, on August 24, Goldman Sachs analyst Tosiah Harry said he expects increased competition from major cloud service providers. However, the analyst expects NVDA to maintain its leadership for the foreseeable future. With that background, let’s check out how much more Nvidia shares can go up.

How much is Nvidia expected to rise?

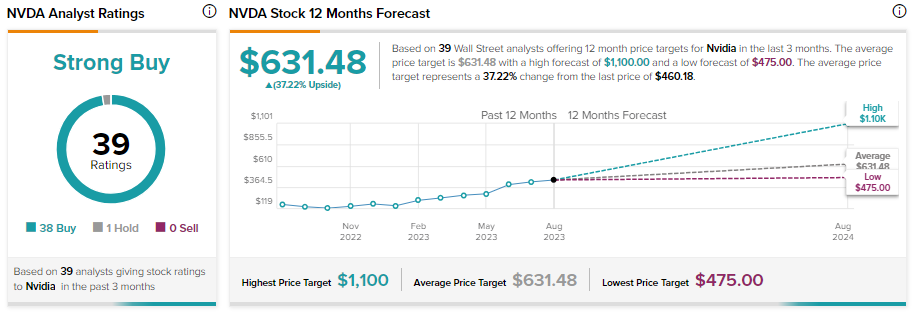

Analysts’ average 12-month price target of $631.8 indicates an additional upside potential of 37.22% from current levels. Despite concerns about growth and competition, analysts maintain a bullish outlook.

With 38 Buy recommendations and 1 comment, Nvidia stock has a Strong Buy consensus rating on TipRanks.

minimum

Analysts find NVDA’s assessment reasonable. In addition, strong demand driven by artificial intelligence will enable Nvidia to achieve strong growth, driving up its share price. Moreover, generating significant cash flow will help Nvidia boost returns for its shareholders through share buybacks.

disclosure

Source link