Goldman Sachs says Nvidia stock is a buy — which is why investors are getting it wrong

semiconductor giant nvidia (Nasdaq: NVDA) released its financial earnings results for the second quarter of 2024 on Wednesday night, and the numbers are pretty impressive.

Quarterly revenue hit a new record of $13.5 billion, up 101% year-over-year, driven by data center revenue (76% of total revenue) which grew 171%. GAAP earnings per share increased 854% yoy, to $2.48, supported by an improvement in gross margin of 450 basis points to 70.1%.

Nvidia smashed analyst expectations with revenue of $11.2 billion and $2.09 per share in earnings. It crushed expectations for future results, too. Instead of the $12.6 billion Wall Street analysts projected for the fiscal third quarter of 2023, Nvidia says it will generate $16 billion in sales (plus or minus 2%), and improve gross margins to 71.5%.

How did investors react to all this good news? They sold Nvidia stock by exactly 0.1% during regular trading hours on Thursday – and then sold it by 2.43% in the trading session on Friday.

One analyst who I imagine was puzzled by this result was Tosiah Harry of Goldman Sachs, who liked Nvidia’s results much more than other investors did. In summing up the second-quarter results, Harry cheered Nvidia outperforming sales forecasts by 21%, and earnings forecasts by 30%.

Of particular interest, Harry says, is the fact that Nvidia’s data center business is doing quite well. The 29% revenue growth in data centers was a bigger surprise than Nvidia’s overall superior revenue performance. As Harry explained, NVIDIA has a deep “competitive moat” around its semiconductors for AI, and “customers are developing/deploying increasingly complex AI models” that require these chips.

In such a situation, Harry predicts, “Nvidia will maintain its position as the industry benchmark for accelerated computing for the foreseeable future.” As important as the demand side of the equation is, Harry emphasized how Nvidia works with its supply chain partners to ensure they can manufacture an adequate supply of chips to meet and benefit from that demand.

Why is this important? Well, mainly because of Nvidia’s size advantages. Look back over real quick. Nvidia’s sales grew 101% year-over-year… but their profits from those sales increased more than eightfold. This is because as Nvidia produces and sells more and more chips, its revenue is growing much faster than its costs. In fact, between the first quarter of fiscal year 2024 and the second quarter of fiscal year 2024, Harry notes, sales grew 88% sequentially, but operating costs only rose 5%.

The difference between these two figures fell directly into the bottom line, inflating Nvidia’s profits. And now Nvidia says revenue will continue to grow faster than expected, and profit margins will be larger than expected in the third quarter.

Small wonder, then, that Harry has repeated a “buy” rating on Nvidia shares, while other investors are selling them. Hari takes the other side of that bet by predicting that Nvidia stock will reach $605 per share over the next 12 months, adding a 28% gain to a stock that’s already up 190% in the past 12 months. (To watch Harry’s track record, click here)

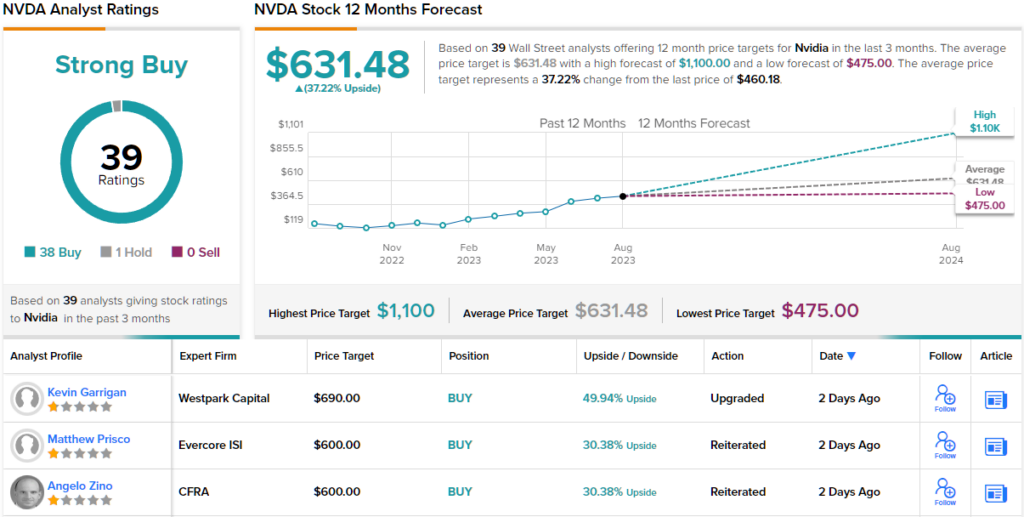

In general, Wall Street obviously likes what you’re seeing here. The stock has 39 recent analyst reviews, broken down into 38 Buys and 1 Hold, for a Strong Buy consensus rating. The stock is selling for $460.18, and the average price target of $631.48 indicates that it has room for growth of about 37% in the coming year. (be seen NVDA Stock Outlook)

To find good ideas for stocks trading at attractive valuations, visit TipRanks Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.

Source link