The sluggish housing market may not heat up anytime soon, analysts say: ‘The party’s over’

Recent data shows that high mortgage rates have helped to dampen the housing market.

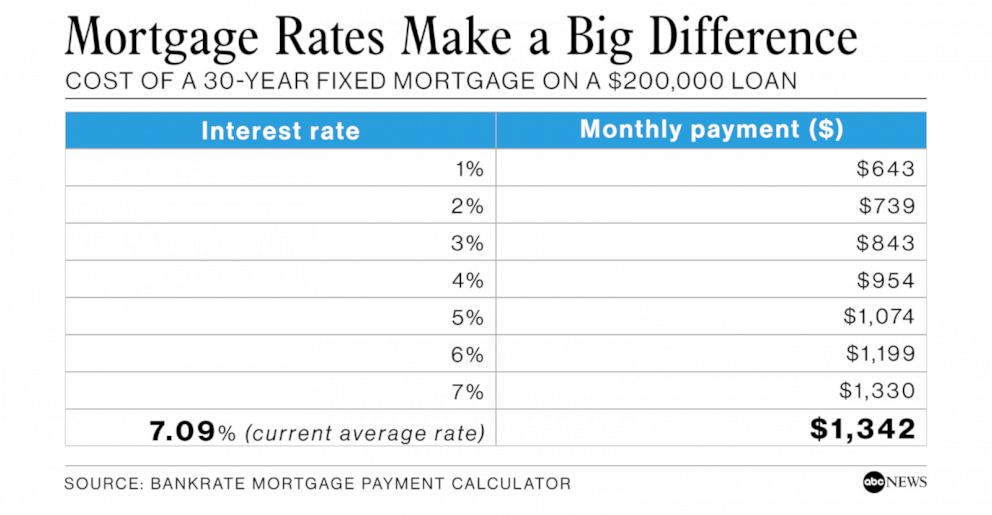

Mortgage rates are at their highest level in 21 years Freddie Mac The data showed last week. The average 30-year fixed-rate mortgage averaged 7.09% during the week ending Thursday, after maintaining levels above 6.5% since May.

Meanwhile, the home resale market slowed in July to its lowest level since 2010.National Association of Realtors The data showed on Tuesday.

Analysts said the lack of supply has pushed up home prices, deterring home buying as potential buyers are caught between the dual pressures of sky-high borrowing costs and stubbornly high listing prices.

They added that the dynamic is unlikely to change significantly in the coming months, as house prices and mortgage rates are expected to remain at or near current levels.

Contrasting the current market with the environment of low mortgage rates that have dominated during the Covid-19 pandemic, Bess Friedman, CEO of real estate firm Brown Harris Stevens, told ABC News: “It is no longer about champagne and caviar. The party is over.” “.

“Buyers are on the fence, short on inventory and high mortgage rates,” Friedman added. “The next few months are likely to be similar.”

The Federal Reserve has rolled out an aggressive series of interest rate hikes as it tries to bring down inflation by slowing the economy and stifling demand.

This means borrowers face higher costs for everything from auto loans to credit card debt to mortgages.

The cost of a 30 year fixed term mortgage on a $200,000 loan

hv news

When the Fed imposed the first interest rate hike of the current series in March 2022, the average 30-year fixed rate mortgage was just 4.45%, Daily mortgage news Data appears.

Each percentage point increase in the mortgage rate can add thousands or tens of thousands of additional costs each year, depending on the price of the house, according to Rocket mortgage.

“It’s all about the Fed,” Lawrence Yoon, chief economist for the National Association of Realtors, told ABC News.

Yoon said many homeowners have resisted selling because they don’t want to part with the relatively low mortgage interest rates, while some buyers are afraid of the extra borrowing costs.

He added that if interest rates were to rise further, this would exacerbate the “dilemma”. If borrowing costs fall, this could flood the market with buyers and sellers.

“Cutting interest rates will immediately lower mortgage rates,” Yoon said.

Federal Reserve Chairman Jerome Powell attends a press conference in Washington, D.C. on July 26, 2023.

Elisabeth Frantz/Reuters, archive

In theory, higher mortgages should drive down home prices, because additional borrowing costs raise the total cost of homes and scare off buyers, Greg Coburn, a real estate professor at the University of Washington, told ABC News.

Coburn added that supply shortages in some areas left prices resisting downward pressure.

“The scarcity of supply is keeping prices higher than they would be with higher interest rates,” Coburn said.

In addition to slowing economic activity, the housing market tends to slow down during the fall months, Urvi Devongi, chief economist at Zillow, told ABC News.

“This is just the seasonality of the housing market, it’s normal,” Devongwe said. “I expect the next couple of months to slow down a bit, especially with mortgage rates going up.”

However, Devongi struck an optimistic tone, noting that a strong influx of new homes is expected to kick in over the coming months, helping to ease the supply-demand imbalance. That, he added, could help ease the burden on homebuyers.

“Buyers will get more breathing space,” he said.

Analysts said potential homebuyers should balance their budget and urgency with market conditions, noting that it is still possible to find the right home during a slow period.

“Even in a crisis, there are opportunities,” Friedman said.

Yoon warned that a better deal may not materialize in a hotter market and lower mortgage interest rates in the future.

“Maybe there are more options,” Yoon said. “But lower interest rates mean more buyers. I would say to consumers, don’t overextend your budget but look at any new listing that comes up. Maybe you’ll get lucky and there won’t be any buyers.”

Source link