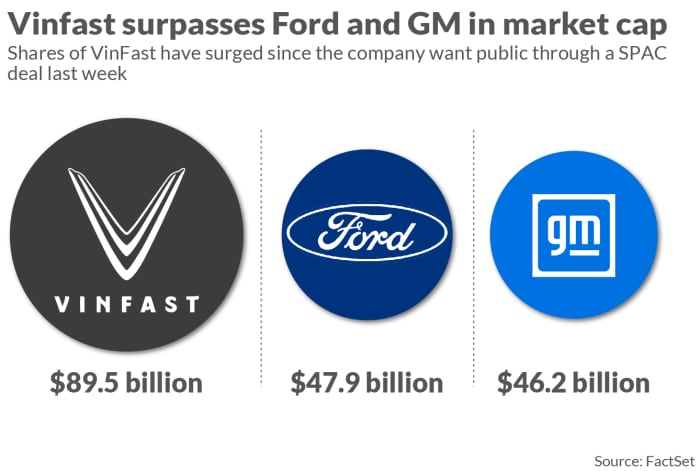

This little-known electric vehicle company has more market capitalization than Ford or GM

Shares of VinFast Auto Ltd. rose. emerging electric vehicle startups since the company went public through a special purpose acquisition deal last week, catapulting its market capitalization to levels far above established automakers such as Ford Motor Co. and General Motors Co.

Low-trading VinFast VFS shares,

It ended Thursday’s session up by 32.3%, raising the company’s market value to $89.5 billion. In comparison, the Ford F,

The market value is $ 47.9 billion, and General Motors General Motors,

It is $46.2 billion, according to FactSet data. Rival electric car maker Rivian Automotive Inc. RIVN,

Its market capitalization is $19.3 billion. However, all of these pale in comparison to Tesla’s own Tesla,

$751.8 billion market value.

In about a week, VinFast’s broadcast on Stocktwits, a social platform for investors and traders, drew about 3,000 viewers, and the volume of messages was “very consistent” throughout the day, according to Tommy Tranfo, head of the Stocktwits community, and Tom Bruni, senior writer for the platform.

Related: Electric vehicle startup VinFast may be worth more than Ford or GM, but there’s a catch

“What everyone is debating is whether or not the current hype in the stock is justified given the workplace,” Tranfo and Bruni said in a statement emailed to MarketWatch, noting the company’s high market capitalization. “This is despite the core business generating less than $1 billion in revenue, with negative cash flow from operations of $1.5 to $2 billion.”

Not supported

In the short term, the stock is trading on momentum and hype, according to Tranfo and Bruni. “But at the end of the day, the results of their business must justify the valuation. As we have seen with other startups in this space, it is easy to say they will achieve XYZ, but it is difficult to actually implement and achieve results.

They added, “On the part of the community: (we) think the thing we’re most interested in right now is if this uproar continues.”

Related: Rivian, Lucid and XPeng among 20 electric vehicle companies expected to grow sales the fastest through 2025

The electric car maker is a majority-owned subsidiary of Vietnamese Vingroup, one of the largest publicly traded companies in Vietnam. VinFast says that as of June 30, 2023, the company has delivered approximately 19,000 electric vehicles.

About 99% of VinFast shares are controlled by Vingroup President and VinFast founder Pham Nhat Vuon, making only a small part available to investors.

Tranfo and Bruni of Stocktwits point out that EVs have a good track record of growing strong support from the retail community. They added: “So there is reason to believe this momentum can continue, but it may be too early to say for sure.” “Retail loves electric cars, so interest is likely to continue no matter how well the company (and the stock) actually does.”

Related: Tesla stock jumps 7% after Byrd highlights Cybertruck and other “catalysts” for the year

VinFast imports its vehicles into the United States and is also expanding its presence in North America. In July, the company began work on an electric vehicle manufacturing site within the Triangle Innovation Point in Chatham County, North Carolina. The electric car startup says the plant will eventually have the capacity to produce 150,000 electric cars annually.

Claudia Assis contributed.

Source link